The IPO is an offering of up to 3,561,636 newly issued registered shares consisting of up to 3,097,074 new shares that are issued in an ordinary capital increase of the Company and, in case of the over-allotment option, of up to 464,562 over-allotment shares, issued by the Company based on

News

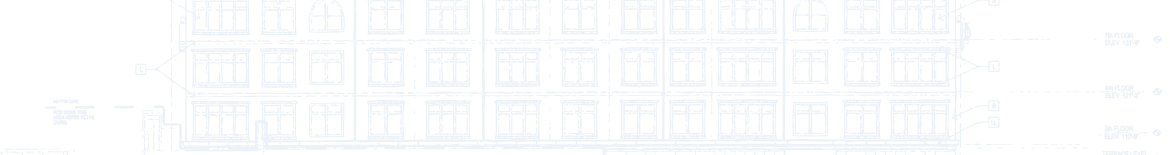

Roadshow video

Discover the video of the roadshow we organized to introduce Varia US properties to investors in Switzerland.

Varia US Properties AG plans IPO and listing on SIX Swiss Exchange

Varia’s portfolio was valued at USD 301 million by Colliers International as of 30 June 2016 and consisted of 39 properties with approximately 5,000 residential units located in 14 US states. The Company generated total income (excluding income from fair value adjustments) of USD 18.9 million and an operating profit

Acquisition of Woodland Manor

On April 1st, 2016, Varia US Properties AG acquired through its subsidiary Varia US Tulsa LLC 95% of a 305-unit Senior LIHTC property in Tulsa, in the state of Oklahoma. The purchase cost is USD 17.438 million.

Acquisition of the Ariston Fund

On February 23rd, Varia US Properties AG acquired 100% of the shares of the Ariston Opportunity Fund LLC, a Bahamas fund holding 23 properties in the US. Those properties were initially acquired thanks to the sponsorship of Peak Capital Partners for the former owners of the Fund. Peak accepted to

Second Capital Increase

Varia US Properties AG successfully achieved its second capital increase on February 3rd, 2016. This additional equity shall allow the company to acquire all the shares of the Ariston Fund, a Bahamas fund that owes 26 residential assets in the United States.

Acquisition of the Florida Portfolio

On December 13, 2015 and according to previous announcement, Varia US Properties AG has secured the acquisition of a portfolio of 13 properties in Florida for a total acquisition cost of USD 75 million. The portfolio is spread between the Orlando region, Jacksonville, Daytona and Pensacola. It comprises 1’686 units

New Board Members Elected

On the General Assembly of December 4, 2015, the shareholders of Varia US Properties AG elected as new board members: – Dany Roizman, external asset manager – Alexander Leviant, asset manager in the US – Thomas Prajer, CEO of Swiss Finance of Property, Zürich

First Capital Increase

Varia US Properties AG successfully achieved its first capital increase on November 12, 2015. This additional equity shall allow the Company to acquire a portfolio of assets in Florida.

Varia US Properties Formation

Varia US Properties AG was formed on September 28, 2015. Its head office is based in Zug, Switzerland. The corporate goal is to invest on the US real estate market. The founder and initial board members are: – Jaume Sabater, CEO of Stoneweg SA, in Geneva – Taner Alicehic, CEO